Posts by Barry Spencer

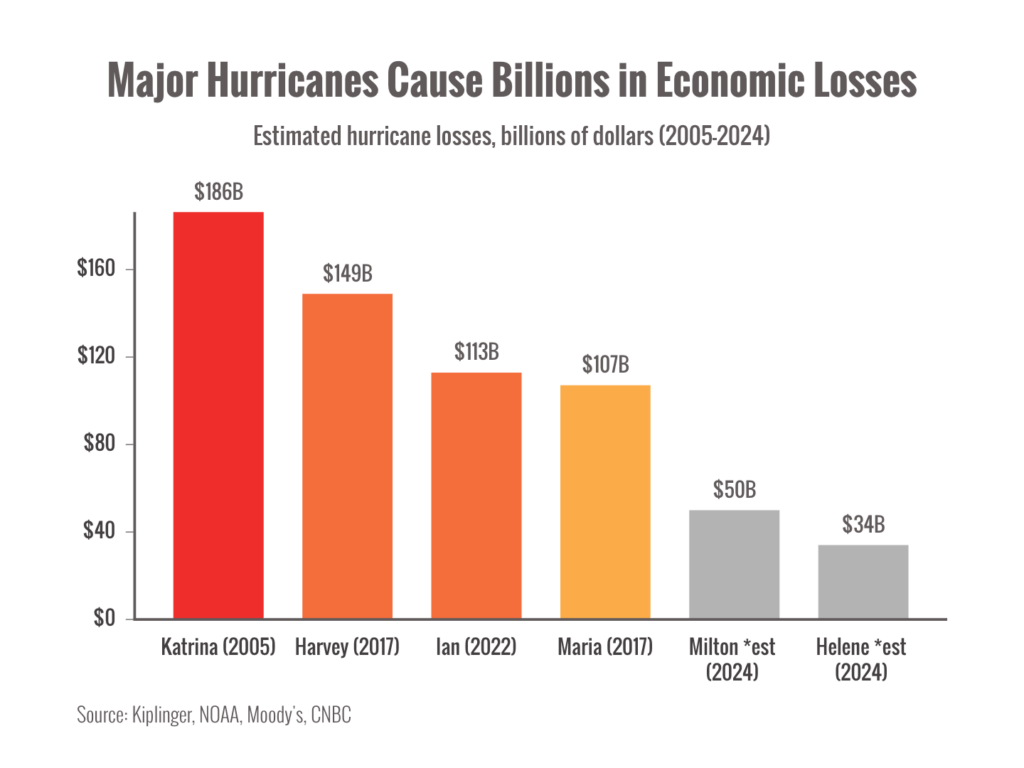

Impact of Hurricanes

Are you well and safe?Have any of your loved ones been impacted by Helene or Milton?Will you comment below, and let me know?It’s been a rough couple of weeks for…

Read MoreDid you know?

The top tax rate has been as high as 94%. The bottom tax rate has been as high as 22%. FDR proposed a 100% top tax rate. During these top…

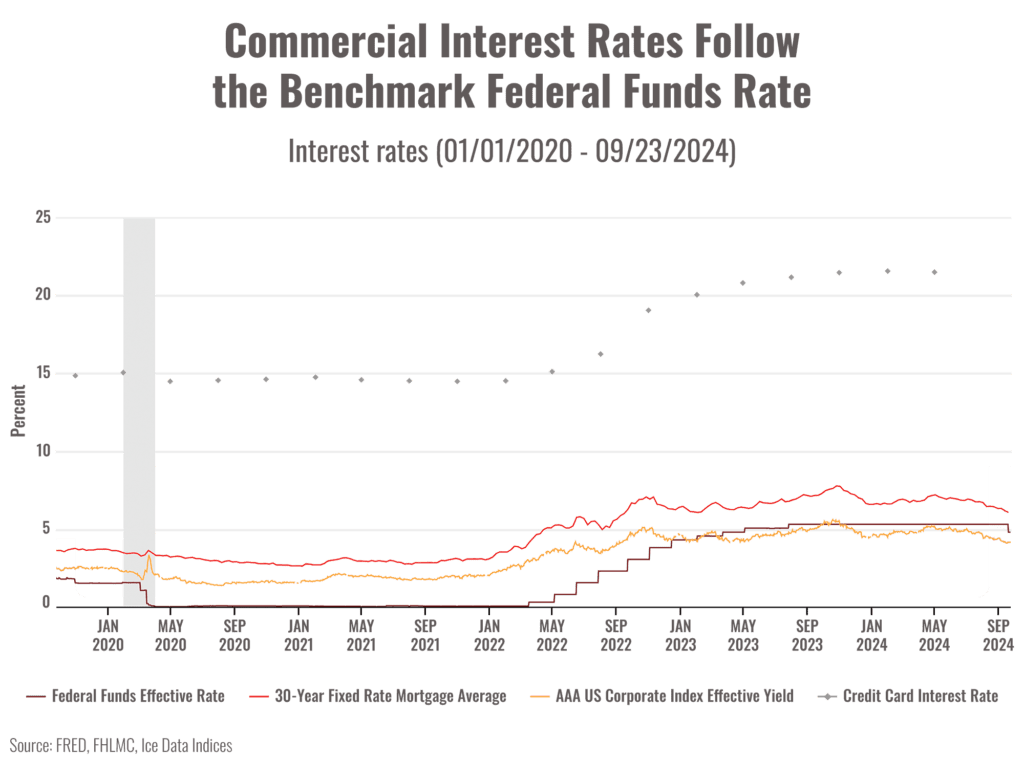

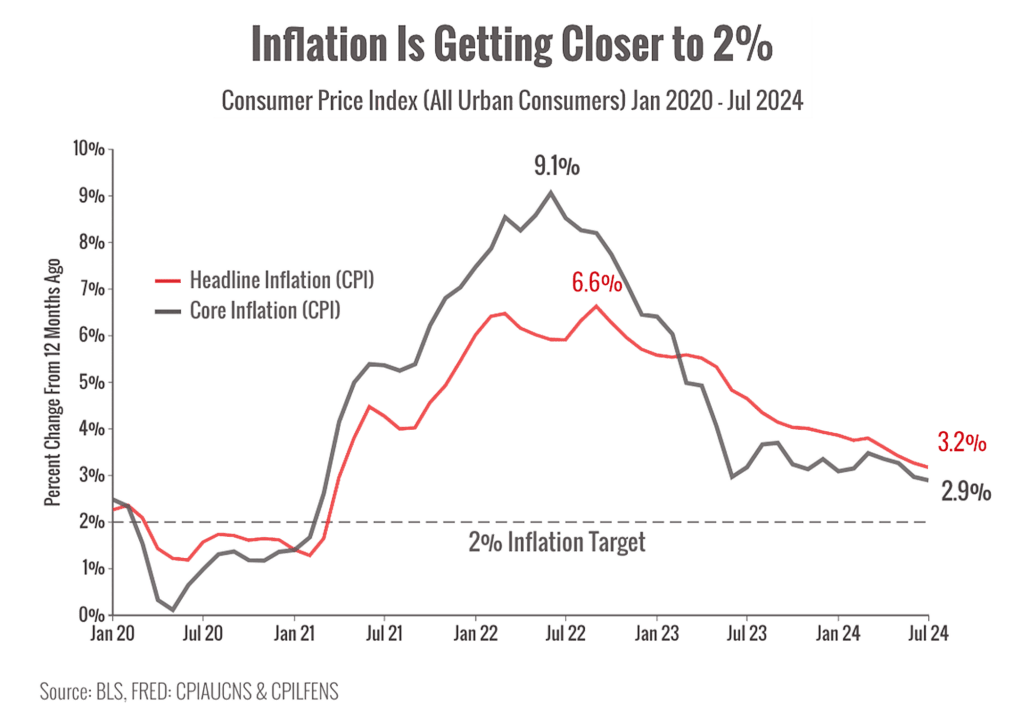

Read MoreLower Interest Rates. Now What?

The Federal Reserve recently voted to cut interest rates, shaving 0.5% off the benchmark. 1Markets rallied exuberantly at the news, reaching new highs. 2Why did the Federal Reserve cut rates?With inflation on…

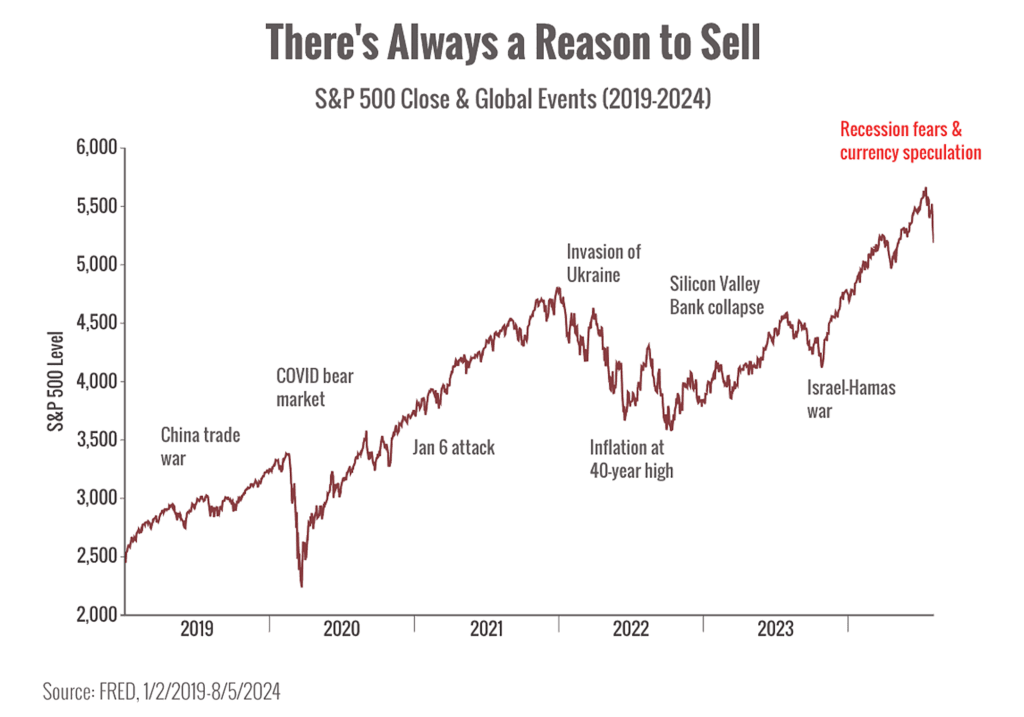

Read MoreWhat’s Going on with the Markets?

Markets tumbled recently, giving their worst performance of 2024.1And then promptly rallied again.If you’ve been reading my recent emails, you’re probably not surprised.Let’s talk about what’s going on.What’s driving the…

Read MoreExploring Your Options is the Only Option

We like to have options—and the more the better. We want more options in our cars, on our phones, and in our business dealings. How many options have you explored…

Read MoreWhat happens next? (market rollercoaster)

It’s been a wild August for markets.Recession fears kicked off the worst selloff since 2022 at the beginning of the month.Then markets staged a choppy recovery, even notching the strongest…

Read MoreIs the Sky Falling?

I’m sure you saw the headlines.After hitting new highs last month, markets experienced a significant decline, erasing months of gains. 1It may feel like the sky is falling.Let’s take a step…

Read MoreHow’s Your Portfolio Doing Today?

Recent market events have left many investors feeling uneasy.The Japanese stock market recently crashed 1, driven by rising unemployment rates (now at 4.3% as of July) 2, disappointing corporate earnings, and the…

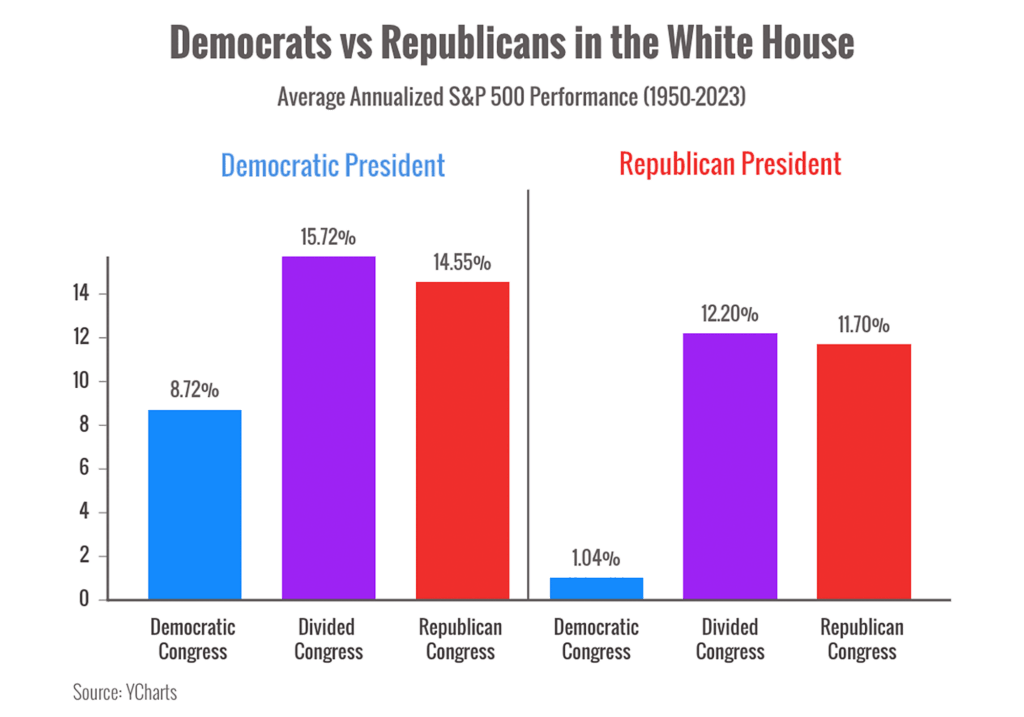

Read MoreElection year volatility? (What it could mean)

A lot has happened recently.After weeks of gains, markets slid as investors took a step back from big technology stocks. 1At the same time, a global IT outage took major corporations…

Read MoreMissing Out on Growth

When you see headlines like, “Nvidia becomes world’s most valuable company…” 1 Or read that a few stocks are responsible for most of the market’s gains… Or see some newsletter…

Read More