Let’s break down what’s happening and why it matters.

What’s driving recent volatility?

Concerns about the impact of inflation and tariffs on consumer sentiment are one major driver. 2 If Americans lose confidence in the economy, they may pull back on spending, which is the biggest driver of economic growth.

Federal workforce reductions are also adding to the uncertainty. The new administration has implemented significant changes by laying off thousands of newer employees and offering buyouts to many more. 3

It’s not yet clear what the long-term effect of these job cuts may be, but the impact may radiate out to other areas of the economy if workers can’t find new jobs and households cut back spending.

Why I’m cautiously optimistic about markets despite the uncertainty

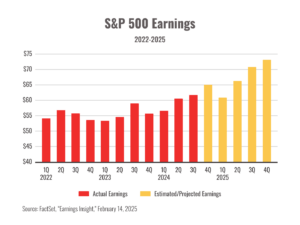

The good news is that Q4 corporate earnings look very positive so far. 4 If trends continue, we could see the largest year-over-year earnings increase since 2021

Please note, it is not possible to invest directly into the S&P 500® Index; this measure is provided solely as a gauge of overall market performance. Standard & Poor’s: “Standard & Poor’s®,” “S&P®,” and “S&P 500®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). The historical performance of the S&P 500 is not intended as an indication of its future performance and is not guaranteed. This chart is not intended to provide investment, tax or legal advice. Be sure to consult a qualified professional about your individual situation. This chart does not take into account investment fees, so actual results may be different than depicted above.

Many companies are also reporting better-than-expected results, suggesting business conditions were stronger than anticipated. 5

With today’s high stock valuations, continued earnings performance remains critical for market growth. If business performance doesn’t keep up with expectations, we can expect a pullback.

What could this mean for your portfolio?

As you probably already know, pullbacks and volatility are a normal part of investing, especially during periods of major uncertainty.

Your portfolio should be designed to help weather these kinds of fluctuations while positioning you to pursue your goals.

When markets retreat, and you start to get nervous, it’s natural to wonder if you should be in the market at all.

It’s a completely normal experience as an investor. But letting your feelings drive your investment decisions doesn’t typically yield great results. In fact, it often accomplishes the opposite.

Abandoning your strategy when markets get choppy and uncertain may mean locking in losses and potentially missing out on future market opportunities.

Not sure that you have a plan you’re confident with in volatile times? Call our office to schedule a time to talk.

Sincerely,

Barry

_________________________________________________________________________

– Peter Bernstein