Is a zombie recession coming?

Many analysts were convinced that the U.S. economy could achieve a coveted “soft landing,” but they might be overly optimistic.

Want to skip the economics? Scroll to the bottom for my big-picture takeaway.

What makes some economists worry about a recession?

Some of the latest concerns are centered around the labor market.

The latest report showed that just 175k jobs were added in April, far below March’s blockbuster number of 315k, and under what analysts were expecting for the month. 2

Jobs numbers from prior months have also been revised downward, indicating softness.

The jobs market has been a mainstay of the strong economy, so weakness could spell trouble.

However, there are two things to keep in mind:

- Signs of a slowing jobs market may help the Federal Reserve regain confidence that inflation will eventually drop to their 2% target, and open up a path to cutting interest rates.

- Trends matter more than a single weak report, so we’ll keep watching the data.

Other warning signals are also flashing.

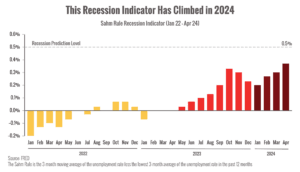

One is the “Sahm Rule” indicator that tracks movement of the unemployment rate to predict recessions. 3

When the 3-month moving average of the unemployment rate spikes 0.5% above its 12-month low, it has historically shown that the U.S. is in the early stages of a recession.

While it’s not showing that the economy is in a recession yet, it’s getting close.

However, other signals are showing strength.

Economic growth slowed significantly in the first quarter of 2024, but American consumers are still spending, particularly on services.

In Q1, spending on services grew at a blistering 4.0% annual rate, the fastest surge since 2021. 4

Since consumer spending makes up 70% of economic growth, how Americans buy is a critical indicator for the economy.

Income (after inflation) is also at its strongest since 2007 as wage growth outpaces inflation. 5

Taken together, there are reasons to be optimistic.

Bottom line: The economic picture is complicated.

We’re still grappling with the effects of multiple years of high rates, pandemic recovery, and other factors blurring the economic picture.

Market performance this year has pivoted on a single big question: When will the Fed cut interest rates?

The economic picture has remained so strong, and inflation so sticky, that expectations for rate cuts have been repeatedly pushed back.

However, signs that the economy is slowing could give Fed economists the reassurance they need to ease rates.

Cutting rates means lowering the cost of mortgages, auto loans, credit cards, and other debt that has made it hard for many Americans (particularly low-income consumers) to feel confident about their financial prospects.

Soft landings are very hard to achieve; while one is still possible, it’s my job to prepare our valued clients for multiple potential outcomes.

My team and I watch the data and work through different scenarios.

Watchfully,

Barry

P.S. Does the current economic uncertainty change your perspective about your own prospects?

I’ve learned that some folks are comfortable with the uncertainty while others feel wary about what the future may bring.

Comment below and share your thoughts with me? I’m interested in hearing about your experience.

Sources:

1. https://finance.yahoo.com/news/u-economy-headed-hard-landing-222148023.html

2. https://www.cnbc.com/2024/05/03/jobs-report-april-2024-us-job-growth-totaled-175000-in-april.html

3. https://www.businessinsider.com/recession-outlook-hard-landing-economy-unemployment-job-market-david-rosenberg-2024-4

4. https://finance.yahoo.com/news/u-economy-actually-wolf-sheep-192424119.html

5. https://hbr.org/2024/05/the-u-s-economys-soft-landing-is-still-on-track

Chart sources: https://fred.stlouisfed.org/series/SAHMREALTIME#0

_____________________________________________________________________________

– Peter Bernstein

Thanks