Markets tumbled recently, giving their worst performance of 2024.1

And then promptly rallied again.

If you’ve been reading my recent emails, you’re probably not surprised.

Let’s talk about what’s going on.

What’s driving the volatility?

Profit-taking, for one.

Markets notched big gains in August, and traders decided to cash in some profits, which drove prices lower. 2

Economic concerns are also in focus again.

The latest jobs report showed that the labor market is slowing down, as feared.

August data showed that jobs grew by a lukewarm 142,000, missing expectations. 3

Data for prior months was also revised downward, giving July the lowest job creation number since December 2020.

Markets dropped in response to the data, largely out of worries about growth.

This behavior is the flipside of the trend we’ve seen repeatedly this year – where markets reacted positively to “bad” news because traders hoped it would boost the case for a cut in interest rates by the Federal Reserve.

Now, bad news is bad news again. Unless it’s good news.

It’s about as clear as mud.

We can expect this kind of vacillation between optimism and worry to continue.

What happens next?

Markets have had an overall strong run this year through the end of August. 4

Now, we may be entering a chopp(ier) season for markets.

We have a lot of uncertainty on the horizon: economic news, Fed moves, a presidential election, and geopolitical issues that oscillate between heating up and cooling off.

It wouldn’t be surprising at all to see more volatility or a bigger correction as investors digest Fed policy and economic data.

However, the fundamentals still support growth.

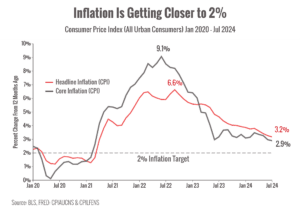

Inflation is heading lower toward the 2% goal. 5

It’s always tempting to tactically sell and wait out rocky markets.

The problem is that it leaves you on the sidelines when markets move again.

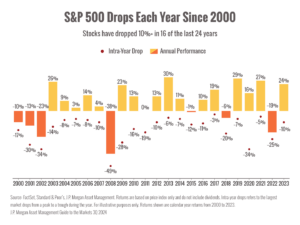

The chart below shows significant market drops since 2000.

You can see that corrections happen pretty regularly. Even in positive years.

But no one can.

We build strategies based on our own goals and harness the market to put our portfolios to work.

We make careful adjustments and tactical shifts when needed.

But we don’t let short-term market moves throw us off course.

My team and I are watching and will keep you up to date throughout what’s likely to be a rocky fall.

If you have any questions or concerns, comment below and let me know.

Sincerely,

Barry

Sources:

1. https://www.cnbc.com/2024/09/08/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/09/09/fed-jumbo-50-bps-rate-cut-should-not-raise-alarm-analyst-says.html

3. https://www.foxbusiness.com/economy/us-jobs-report-august-2024

4. https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes/

5. https://www.reuters.com/markets/rates-bonds/traders-see-fed-delivering-25-bps-cut-sept-100-bps-by-year-end-2024-08-30/

6. https://www.atlantafed.org/cqer/research/gdpnow

Chart sources:

https://fred.stlouisfed.org/series/CPIAUCNS#0, https://fred.stlouisfed.org/series/CPILFENS#0, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

_____________________________________________________________________________

If it’s unimportant or unknowable, you forget about it.”

– Warren Buffett