I’m sure you saw the headlines.

After hitting new highs last month, markets experienced a significant decline, erasing months of gains. 1

It may feel like the sky is falling.

Let’s take a step back and take a look at what’s going on.

(Scroll to the end if you want my takeaways.)

What’s behind the market drop?

A couple of major factors fueled the sudden selloff:

1. Weaker-than-expected economic data that sparked recession fears.

July’s soft jobs report triggered a recession indicator that caused U.S. stocks to sell off in fear. 2

Though it does not appear that the U.S. is in a recession now, weakening economic data is increasing the risk that a recession could strike.

2. Speculative currency trading by corporate investors.

“Carry trading” is a risky strategy that involves borrowing money in a currency with a low interest rate (such as the Japanese yen) and then reinvesting the money somewhere else where returns are higher. 3

This strategy has become popular in recent years because of Japan’s very low interest rates.

Its success depends on cheap borrowing currencies and low market volatility.

However, that strategy is no longer paying off.

Japan’s central bank recently hiked interest rates, and markets grew more volatile, hitting traders with a double whammy.

The “unwinding” of these speculative investments triggered a global selloff as traders sold positions to cover losses.

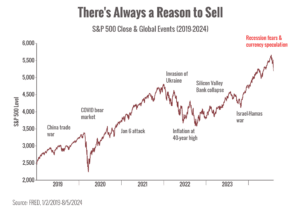

Hard investing truth: there’s always a reason to sell.

Markets are always waiting for the next opportunity to melt down.

That’s part and parcel of being an investor these days.

The market’s fluctuations may prompt feelings of anxiety and fear, often resulting in impulsive selling.

However, it’s important to note that reacting with panic and selling hastily in response to market downturns can be an ill-advised course of action.

Though markets bounced back quickly, it’s possible the volatility and selling pressure will continue.

It’s very common for markets to experience a selloff after reaching historic highs.

We’re watching closely and monitoring the data, including possible Federal Reserve decisions that could move markets.

I’ll be in touch with updates as I have them.

Please comment below if you’re worrying about the current situation.

One of the most important parts of my job is being a reassuring voice and educated opinion when the market jitters hit.

Warmly,

Barry

P.S. It feels like we’re hitting especially uncertain times. With new threats of war, a presidential election, and economic fears, the crystal ball seems very cloudy.

These are the moments when taking a step back and reminding yourself of the why behind your strategy is so important. If you’re not sure what that is with your current plan, let’s talk.

Sources

1. https://www.cnbc.com/2024/08/04/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/08/05/recession-what-is-the-sahm-rule-and-why-is-everyone-talking-about-it.html

3. https://www.cnbc.com/2024/08/05/carry-trades-a-major-unwinding-is-underway-amid-a-stock-sell-off.html

Chart sources:

https://fred.stlouisfed.org/series/SP500#0

https://www.imf.org/en/Blogs/Articles/2019/05/23/blog-the-impact-of-us-china-trade-tensions

https://www.cnbc.com/2021/03/16/one-year-ago-stocks-dropped-12percent-in-a-single-day-what-investors-have-learned-since-then.html

https://www.sciencedirect.com/science/article/abs/pii/S1544612323004208

https://www.bbc.com/news/world-europe-60506682

https://www.cnn.com/2022/07/13/economy/cpi-inflation-june/index.html

https://www.law.uw.edu/news-events/news/2023/svb-collapse

https://www.bbc.com/news/world-middle-east-67039975

https://www.cnbc.com/2024/08/05/stock-market-today-live-updates.html

_____________________________________________________________________________

– Shelby M.C. Davis