President Trump wins. Now what?

November 12, 2024

Blog | Estate Planning | Financial Growth | Life & Planning | Retirement

President Trump has won reelection; what does that mean for investors?

Let’s discuss.

Markets reacted to the news by rallying to new record highs. 1

Does that indicate they see president-elect Trump’s promises as favorable for stocks?

Or is it simply a reaction to an end to election-related uncertainty?

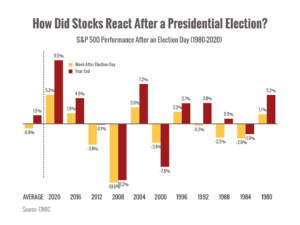

History can offer us some clues. 2

On average, stocks tend to rise after an election after a small short-term drop.

But you can see in the chart below that the last two elections have resulted in an immediate pop.

Please note, it is not possible to invest directly into the S&P 500® Index; this measure is provided solely as a gauge of overall market performance. Standard & Poor’s: “Standard & Poor’s®,” “S&P®,” and “S&P 500®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). The historical performance of the S&P 500 is not intended as an indication of its future performance and is not guaranteed. This chart is not intended to provide investment, tax or legal advice. Be sure to consult a qualified professional about your individual situation. This chart does not take into account investment fees, so actual results may be different than depicted above.

Will this year’s positivity remain? We’ll see.

While past performance is a guide, it’s not a guarantee.

Markets are likely to remain volatile in the weeks ahead as investors digest data and adjust their positions ahead of the new year.

Longer term, what can we expect for the economy?

The Federal Reserve recently voted to cut interest rates again. 3

While small rate cuts may not make an immediate impact on the consumer rates you see, they start to add up over time.

If the Fed continues on the rate-cutting path, we could expect to see a cumulative impact on mortgage rates, credit cards, and other consumer and business debt next year.

President-elect Trump campaigned on major economic issues such as tariffs and tax cuts.

Generally speaking, tariffs are considered to be inflationary because they increase the cost of goods. 4

However, the economic impact will largely depend on the size and breadth of any tariffs imposed as well as overall economic conditions.

Tax cuts generally help spur growth (though they can add to the national deficit), and we can anticipate that many provisions of the 2017-era cuts will be extended after 2025. 4

Overall, we’ll see what the new administration chooses to prioritize and how much sway Congress will exert on the agenda.

Bottom line: who wins an election is just one factor affecting markets and investors.

As we approach the final weeks of 2024, we’re thinking ahead to 2025 and evaluating moves for our clients.

We’re optimistic about where markets and the economy are headed and will reach out with updates as we have them.

Warmly,

Barry

Sources:

1. https://www.cnbc.com/2024/11/05/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/11/04/what-the-stock-market-typically-does-after-the-us-election-according-to-history.html

3. https://www.cnbc.com/2024/11/07/fed-rate-decision-november-2024.html

4. https://www.wsj.com/economy/what-a-trump-win-means-for-the-economy-50de4670

Chart Source:

https://www.cnbc.com/2024/11/04/what-the-stock-market-typically-does-after-the-us-election-according-to-history.html

While past performance is a guide, it’s not a guarantee.

Markets are likely to remain volatile in the weeks ahead as investors digest data and adjust their positions ahead of the new year.

Longer term, what can we expect for the economy?

The Federal Reserve recently voted to cut interest rates again. 3

While small rate cuts may not make an immediate impact on the consumer rates you see, they start to add up over time.

If the Fed continues on the rate-cutting path, we could expect to see a cumulative impact on mortgage rates, credit cards, and other consumer and business debt next year.

President-elect Trump campaigned on major economic issues such as tariffs and tax cuts.

Generally speaking, tariffs are considered to be inflationary because they increase the cost of goods. 4

However, the economic impact will largely depend on the size and breadth of any tariffs imposed as well as overall economic conditions.

Tax cuts generally help spur growth (though they can add to the national deficit), and we can anticipate that many provisions of the 2017-era cuts will be extended after 2025. 4

Overall, we’ll see what the new administration chooses to prioritize and how much sway Congress will exert on the agenda.

Bottom line: who wins an election is just one factor affecting markets and investors.

As we approach the final weeks of 2024, we’re thinking ahead to 2025 and evaluating moves for our clients.

We’re optimistic about where markets and the economy are headed and will reach out with updates as we have them.

Warmly,

Barry

Sources:

1. https://www.cnbc.com/2024/11/05/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/11/04/what-the-stock-market-typically-does-after-the-us-election-according-to-history.html

3. https://www.cnbc.com/2024/11/07/fed-rate-decision-november-2024.html

4. https://www.wsj.com/economy/what-a-trump-win-means-for-the-economy-50de4670

Chart Source:

https://www.cnbc.com/2024/11/04/what-the-stock-market-typically-does-after-the-us-election-according-to-history.html

_____________________________________________________________________________

“If you don’t have time to do it right, when will you have the time to do it over?”

– John Wooden

– John Wooden