Lower Interest Rates. Now What?

October 1, 2024

Blog | Estate Planning | Financial Growth | Life & Planning | Retirement

The Federal Reserve recently voted to cut interest rates, shaving 0.5% off the benchmark. 1

Markets rallied exuberantly at the news, reaching new highs. 2

Why did the Federal Reserve cut rates?

With inflation on a strong downward trajectory and concerns about economic weakness rising, the Fed clearly decided now was the right time to cut.

The size of the cut was a surprise to many, who expected a quarter-point cut and could indicate that the Fed feels strong action is warranted.

Some analysts believe lowering interest rates will lower the risk of a recession and increase the odds of a “soft landing” for the economy. 3

What do lower rates mean?

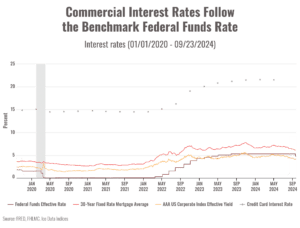

The Fed is responsible for setting the benchmark interest rate that all other borrowing rates follow.

A lower benchmark will reduce borrowing costs for businesses and consumers, helping economic growth accelerate in the months to come.

You can see that while commercial rates don’t change immediately after a rate cut, they generally follow the same trend.

Going forward, mortgages will become cheaper, likely boosting the real estate market.

Business borrowing costs will drop, giving a bump to industries like technology, which rely on credit to fund R&D.

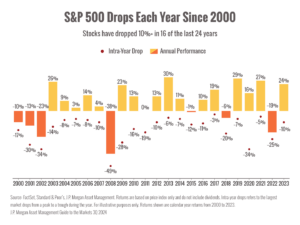

Historically, stocks have tended to do well when rates drop. 4

However, past performance doesn’t predict the future and there’s no guarantee that equities will follow any conventional path.

Today’s volatile markets are still grappling with post-pandemic distortions and are dominated by high-flying tech stocks.

Markets have rallied strongly in 2024, largely on hopes of lower interest rates.

Now that the Fed has finally cut rates, it’s likely that traders will turn their attention to other factors.

We expect the presidential election to come into focus as we approach November.

Analysts will also be closely reading economic reports for hints about recession risks and economic growth in 2025.

All told, we’re expecting plenty of volatility ahead.

We’re watching closely and researching different market scenarios for Q4 and 2025.

Sincerely,

Barry

Sources

1. https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html

2. https://www.usatoday.com/story/money/2024/09/19/dow-sp-500-record-fed-cut/75297962007/

3. https://www.cnbc.com/2024/09/24/goldman-feds-jumbo-rate-cut-puts-the-us-on-track-for-soft-landing.html

4. https://www.schwab.com/learn/story/what-past-fed-rate-cycles-can-tell-us

Chart sources:

https://fred.stlouisfed.org/series/DFF

https://fred.stlouisfed.org/series/MORTGAGE30US

https://fred.stlouisfed.org/series/BAMLC0A1CAAAEY

https://fred.stlouisfed.org/series/TERMCBCCALLNS

https://www.schwab.com/learn/story/what-past-fed-rate-cycles-can-tell-us

_____________________________________________________________________________

If it’s unimportant or unknowable, you forget about it.”

– Warren Buffett