Clouds may be gathering. Should investors be worried about a storm?

Let’s look at some factors that could trigger a market selloff in the weeks or months ahead.

(Note: I’m not saying a selloff is definitely going to happen—I want you to be prepared if it does.)

Factor #1: Stocks are trading near record highs

Stocks have posted multiple record closes, and the S&P has been trading well above its 200-day moving average. 1, 2

When stocks repeatedly push new highs, it’s not uncommon to see a pullback as traders take profits.

Factor #2: Investors are watching the Fed like hawks

The Fed voted to keep rates steady at its most recent meeting, which wasn’t a surprise since the latest data didn’t show enough improvement in inflation. 3

At this point, the market is pricing in the expectation of a fall rate cut. 4

However, if the Fed indicates that it will delay rate cuts into 2025, markets may drop as investors revise their expectations.

Given that the European Central Bank and Bank of Canada recently voted to cut interest rates, it doesn’t seem likely that the Fed will be far behind. 5, 6

Factor #3: A “trigger event” could cause a selloff

Sometimes, even when overall conditions look good, a single event causes investor psychology to flip and markets to drop.

We can’t predict these events, but we can accept that they show up occasionally and build flexibility into our investing approach.

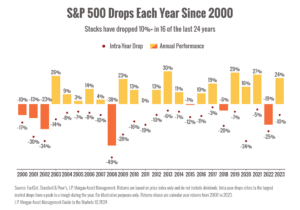

The chart below shows market drops in the S&P 500 since 2000.

You can see that markets have fallen at least 10% in the vast majority of years.

However, most of those years still ended in the green.

The big takeaway? Market drops are normal. They happen frequently.

Should you sit on the sidelines to wait out the uncertainty?

There’s an old investing adage that may have made sense once: “Sell in May and go away.”

The idea is that an investor ought to sit the summer out and buy back in later in the year.

That folksy advice might have made sense back in a more industrial economy when American factories would shut down during the summer to retool and give employees time off.

Today, that kind of advice simply doesn’t match our complex world.

Markets move quickly, and sitting on the sidelines often means missing out on the recovery.

The overall case for the economy and stocks remains bullish.

I’d like you to relax and enjoy the beginning of summer with your family and friends.

Does your current plan leave you feeling confident, despite uncertainty? If not, click here to schedule a call with me– let’s chat.

Barry

Sources:

1. https://www.morningstar.com/news/marketwatch/20240610458/stocks-on-the-road-again-to-record-highs-says-ubs

2. https://www.cnbc.com/2024/06/10/stock-market-today-live-updates.html

3. https://www.cnbc.com/2024/06/12/fed-meeting-today-on-interest-rate.html

4. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

5. https://www.reuters.com/markets/rates-bonds/bank-canada-cuts-rates-first-time-four-years-2024-06-05/

6. https://www.bbc.com/news/articles/c511jy6z41vo

Chart sources:https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/mi-guide-to-the-markets-us.pdf

_____________________________________________________________________________

– John Wooden