Are you well and safe?

Have any of your loved ones been impacted by Helene or Milton?

Will you comment below, and let me know?

It’s been a rough couple of weeks for us in the Southeast, and I wanted to check in.

Storms can take a massive toll on families and communities, with challenges that take months and years to resolve.

With an active hurricane season upon us, I’d like to take a moment to talk about how natural disasters can affect markets and the economy.

Natural disasters typically impact the economy in a few ways:

- Regional, national, and even international supply chains can be disrupted as roads and ports close and goods struggle to move from place to place

- Economic growth can slow down as businesses shut down, jobs are lost, and consumer demand slows down

- Markets often experience short-term volatility as investors react to the news and rush to buy and sell

- Energy prices may spike due to scarcity and supply disruptions

While some companies (such as insurers) typically take a hit from anticipated disaster losses, other businesses (like generator manufacturers) may see a spike due to expected demand. 1

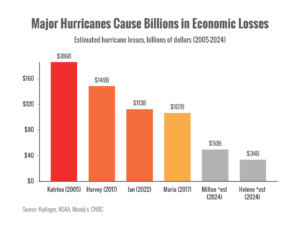

This chart shows the financial cost of some hurricanes in the last two decades:

While natural disasters may have a severe short-term impact on local and regional economies, research suggests the long-term negative effects are limited. 2

One note to consider: estimates of Helene and Milton damage may be low as it may take years to account for the full cost of property damage, business closures, and economic disruption.

Let’s also keep in mind that billions of dollars in financial losses are massive, but they’re still a drop in the bucket of the overall economy, which is over $27 trillion in size. 3

Of course, the plain numbers don’t tell the full story of lives lost and lives disrupted.

Hard-hit areas may take a long time to recover, and some places may never fully return to normal.

In the weeks and months to come, we may see an impact from the hurricanes on inflation, unemployment, and growth data.

Storms are just one factor we’re watching this fall.

Markets are also grappling with rising tensions in the Middle East as well as the politics of the upcoming election.

We’re also monitoring inflation and labor market data for hints as to when the Federal Reserve might cut rates again.

Be well, be safe, and hug your loved ones extra tight.

Warmly,

Barry

Sources:

1. https://www.cnbc.com/2024/10/07/generator-maker-generac-soars-insurance-stocks-fall-on-hurricane-milton.html

2. https://www.frbsf.org/wp-content/uploads/wp2020-34.pdf

3. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2023&locations=US&start=1960&view=chart

Chart sources: https://www.investors.com/news/hurricane-helene-34-billion-price-tag-stock-market-impact/

https://www.cnbc.com/2024/10/08/hurricane-milton-could-cause-as-much-as-175-billion-in-damages-according-to-early-estimates.html

https://www.kiplinger.com/slideshow/business/t019-s001-most-expensive-natural-disasters-in-u-s-history/index.html

_____________________________________________________________________________

– Joyce Meyer