Market Swings & Your Portfolio: What Really Matters

March 18, 2025

Blog | Estate Planning | Financial Growth | Life & Planning | Retirement

You’ve seen the headlines—market selloffs, recession worries, and trade tensions have investors on edge.

But here’s the thing: Market moves like this aren’t new, and they certainly aren’t the end of the story.

So, what’s really happening? And more importantly, what should you do about it?

What’s Happening

- Economic Uncertainty: Citigroup just downgraded U.S. equities to neutral, citing economic uncertainty. That doesn’t mean we’re heading off a cliff—it means investors are recalibrating their expectations. 1

- Trade Tensions : The U.S. slapped new tariffs on key imports, prompting immediate responses from Canada, Mexico, and China. These moves add short-term volatility and long-term uncertainty (but it’s too early to know for sure how these moves will play out.) 2

- Market Roller Coaster: The S&P 500, Nasdaq, and Dow all took hits, with the Nasdaq suffering its worst single-day drop since 2022 on Monday the 10th. Even Magnificent Seven stocks like Tesla and Nvidia were down significantly. 3

Sure, all this can be scary when you see it dominating the headlines. But what is the bigger picture?

The Big Picture

Market turbulence can feel like a gut punch, but history tells us that patience pays. Take March 2000: The Nasdaq was flying high after a five-year rally, only to drop 60% over the next year. Brutal, right? But investors who stayed the course saw strong recoveries in the years that followed. 4

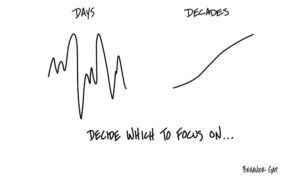

Take a look at this sketch. Think about its message.

We. Get. To. Decide. What. We. Focus. On.

When it comes to investing, that means you have a choice.

Left side: You can tune into the financial networks, go through endless cycles of “buy buy, sell sell,” obsess over the latest financial product, and deal with the apocalypse du jour while cycling through all the emotions that come with it.

OR…

Right side: You can focus on what actually matters when it comes to investing. And that’s time. A very long time: decades.

The takeaway? Your investment strategy shouldn’t be dictated by headlines.

Looking Ahead

With key inflation data coming up, we could see more market swings. But staying grounded in a well-thought-out strategy is the difference between reacting emotionally and investing wisely.

- Stick to Your Plan. Your investment strategy should be built for the long haul, not week-to-week swings. Not sure? Let’s talk.

- Look for Opportunities. Volatility creates buying opportunities for long-term investors. If you’re considering adjusting your portfolio, consider smart, strategic moves.

Market swings are normal, but you don’t have to go through them alone. A trusted advisor is in this with you, through every market cycle.

Not having the proactive conversations with your advisor you had hoped for in this current volatility? Reach out to schedule a conversation- let’s talk!

Warmly,

Barry

_________________________________________________________________________

– Wilson Mizner