New research has found a new “magic” retirement savings number.

(I explain how inflation factors in below.)

I say “magic” because if you put 10 people in a room, you’ll get 10 different opinions about how much you should save for retirement.

And this estimate is no different.

Northwestern Mutual surveyed 4,588 adults and found:

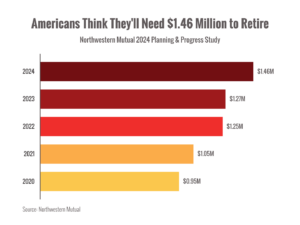

The new “magic” number for a comfortable retirement is $1.46 million. 1

It’s up 15% from last year’s $1.27 million number and is also an eye-popping 53% higher than the 2020 estimate. 2

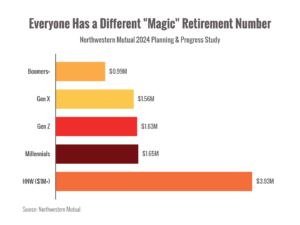

Broken down by generation, the numbers get even bigger.

Gen Z and Millennials expect to need around $1.6 million to comfortably retire. 1

And folks with over $1 million saved believe they’ll need nearly $4 million to be comfortable.

Does the average American actually need $1.46 million to retire comfortably?

Probably not.

Another “magic” number from Fidelity suggests Americans should have 10x their income saved by age 67. 3

If we 10x the median household income of $74,580, we get $745,800. 4

That’s about half of the first “magic” number.

For some Americans, $750k will be enough to retire on.

For others, it won’t be nearly enough to support the lifestyle they want.

Planning for retirement isn’t about “magic” numbers.

When we consider that the average retirement savings hovers around $88,000, the gap between desire and reality has never been greater. 1

Most people don’t really know how much money they will need in retirement, and can wildly overestimate it.

As much as humans like to look for simple answers and rules to follow, turning a portfolio into retirement income is complex.

I wish I could give each person in that survey an advisor to help them calculate their own retirement target instead of guessing.

Inflation is weighing heavily on our fears for the future.

Inflation has been very high for the last few years, and (in my opinion) the survey reflects the worry many feel about how much prices are rising.

And how long high inflation will linger.

The latest March report shows that prices rose 3.5% over the last 12 months. 5

That’s stronger than analysts had expected, and increases concerns that inflation isn’t actually tamed yet.

This negative surprise is likely to push back a Fed interest rate cut and stoke market volatility.

Be well,

Barry

P.S. What do you think about “magic” retirement numbers? Do you think they’re useful? Do you have any questions about your retirement you haven’t asked me? Comment below, and let me know.

Sources:

1. https://news.northwesternmutual.com/2024-04-02-Americans-Believe-They-Will-Need-1-46-Million-to-Retire-Comfortably-According-to-Northwestern-Mutual-2024-Planning-Progress-Study

2. https://news.northwesternmutual.com/2023-06-22-Americans-Believe-They-Will-Need-1-27-Million-to-Retire-Comfortably,-According-to-Northwestern-Mutual-Planning-Progress-Study

3. https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire

4. https://www.census.gov/library/publications/2023/demo/p60-279.html

5. https://www.cnbc.com/2024/04/10/cpi-inflation-march-2024-consumer-prices-rose-3point5percent-from-a-year-ago-in-march.html

Chart source:https://news.northwesternmutual.com/2024-04-02-Americans-Believe-They-Will-Need-1-46-Million-to-Retire-Comfortably-According-to-Northwestern-Mutual-2024-Planning-Progress-Study

_____________________________________________________________________________

– Alan Lakein